Business transactions such as mergers, acquisitions, and reorganizations often necessitate the pricing and valuation of financial transactions. Applying different standards may result in different pricing or valuation for the same financial transaction. Therefore, identifying the appropriate valuation standard is crucial.

Companies must comply with ever-evolving financial and tax reporting requirements when pricing and valuing financial transactions, dealing with increasing financial audit and tax authority scrutiny, and considering other regulatory and compliance elements. Independent pricing and valuation assessments can significantly help companies to negotiate, structure, and effectively close transactions while ensuring compliance with all relevant transaction-related financial and tax reporting requirements.

Choosing the Appropriate Valuation Standard and Method

Before performing a valuation, it is essential to identify the appropriate valuation standard and methodology, since different standards may impact the results. Differences may arise between fair value (FV) established for financial reporting purposes and values derived from either of the two tax reporting standards, the fair market value (FMV) standard and the arm’s-length standard (ALS).

Sometimes, a valuation must satisfy multiple standards. For instance, an FV analysis for financial reporting and an FMV analysis for tax reporting may be required for purchase price allocations in an acquisition, followed by an ALS pricing analysis for transfer pricing purposes in a post-acquisition business reorganization. The three standards share similar principles and methods but diverge at many points.

Companies may need to consider multiple factors for each valuation standard, regardless of the standard used, before establishing a value. This article highlights some relevant valuation considerations from financial and tax reporting perspectives regarding the pricing and valuation of financial transactions, including the differences among the FV, the FMV, and the ALS. Other types of assets, such as tangible assets, intangible assets, and business enterprise valuations, are outside the scope of this article.

For context, we provide an overview of the three valuation standards, including the relevant regulatory guidance and the definition of each standard.

Fair Value Standard

The FV standard described in Financial Standards Accounting Board ASC 820 applies for US financial reporting purposes. According to ASC 820, FV is the price received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.1

ASC 820 emphasizes that FV is a market-based measurement, not an entity-specific one. Management’s intended use of an asset or planned method of settling a liability is irrelevant when measuring fair value. Instead, determining the FV of an asset or liability relies on a hypothetical transaction at the measurement date, considered from the perspective of a market participant.2

ASC 820 establishes an FV framework applicable to all FV measurements. Under this framework, fair value is measured based on an exit price (not the transaction or entry price) determined using several key concepts, including market participants, the unit of account, the principal (or most advantageous) market, and the FV hierarchy.3

Fair Market Value Standard

The FMV standard described in Internal Revenue Ruling 59-60 applies for US tax reporting purposes. FMV is the price at which the property would change hands between a willing seller and a willing buyer when the seller is under no compulsion to sell and the buyer is under no compulsion to buy, with both parties having reasonable knowledge of relevant facts.4

Arm’s-Length Standard

The ALS is a tax valuation standard applied to determine arm’s-length results in controlled transactions. The ALS aims to place controlled taxpayers on tax parity with uncontrolled taxpayers by determining the true taxable income of controlled taxpayers according to the standard of uncontrolled taxpayers dealing at arm’s-length.5

According to Treasury Regulations Section 1.482, a controlled transaction meets the ALS if the transaction results are consistent with those that would have been realized if uncontrolled taxpayers engaged in the same transaction under the same circumstances.6

Valuation Methods Under FV and FMV Standards

This section highlights the valuation methods under the aforementioned three valuation standards. As noted earlier, the FV and FMV standards differ, but the primary valuation approaches are broadly consistent across the two standards. For this reason, this section covers the primary approaches and methods jointly for these two standards.

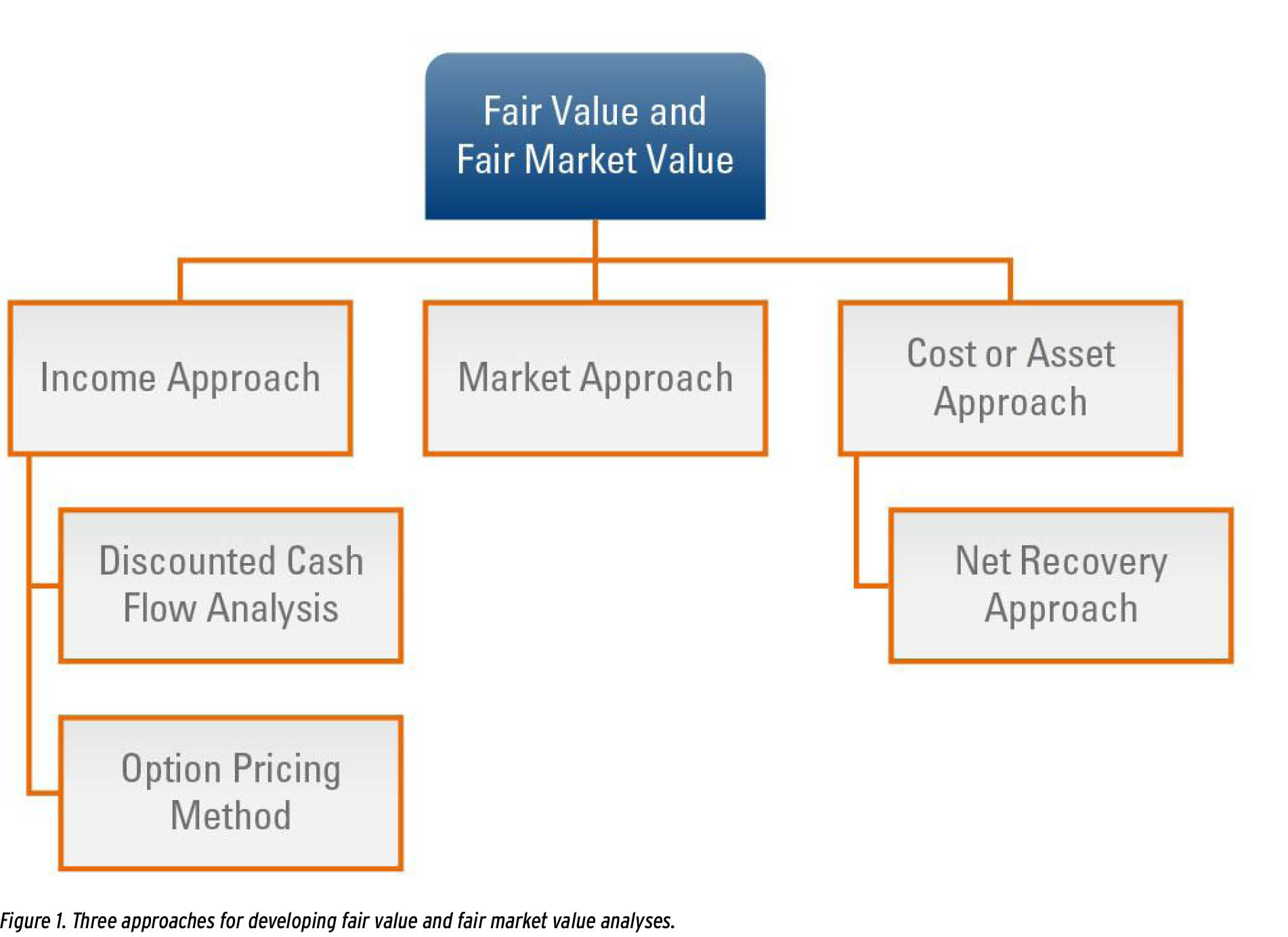

Figure 1 summarizes the three primary valuation approaches under the FV and FMV standards: the income approach, the market approach, and the cost or asset approach. The three approaches are defined as follows:

- income approach—determines the value of a financial transaction based on projected cash flows derived from the transaction, discounted to present value through an appropriate discount rate determined based on the facts and circumstances of the transaction. This approach is often used for pricing and valuing performing debt, where asset value exceeds debt value;

- market approach—establishes the value of a financial transaction based on market values from public companies, reference transactions, and funding announcements. Applying this approach may be challenging if reliable financial transactions comparable to the specific transaction are unavailable; and

- cost or asset approach—estimates the financial transaction’s value based on the amount recoverable upon liquidation. This approach is often used for pricing and valuing nonperforming debt, where debt value exceeds asset value.

In the following sections, we describe each valuation approach in detail.

Income Approach

The income approach is commonly applied in the pricing and valuing of performing debt, where business enterprise value exceeds debt value. The most frequently used technique under this approach is the discounted cash flow analysis, which determines the debt value based on projected cash flows discounted to present value with an appropriate discount rate. The discounted cash flow analysis typically includes the following primary steps:

- Projecting cash flow streams—establish the cash flow streams associated with the debt, including appropriate projected interest payments and principal amount (that is, the debt schedule).

- Establishing debt terms—determine the terms of the debt, such as principal amount, issue date, maturity date, currency, amortization schedule, and interest rate (including if interest is paid-in-kind).

- Performing credit analysis—review company fundamentals, including credit metrics such as cash flow coverage, fixed charge coverage, and loan-to-value ratio of the subject security. This may involve establishing a credit rating if necessary.

- Determining discount rate—analyze the terms of the debt, company fundamental performance, and debt market spreads to determine an appropriate discount rate.

- Discounting cash flows—discount the projected cash flow streams to present value using the discount rate.

Cash Flows

In a discounted cash flow analysis, an appropriate cash flow stream derived from the debt must be established as a basis. The cash flow stream is generally well-established for fixed-term performing debt since the principal amount, issue date, maturity date, currency, amortization schedule, and interest rate (and form of interest) are contractually defined in the debt agreement.

The projected cash flow streams may be less certain for other cases, such as revolving credit facilities, convertible debt, or nonperforming term debt. Additional valuation techniques may be required. For example, in the case of nonperforming debt, an enterprise value coverage analysis may be performed to establish the appropriate recovery value of the debt. In the case of convertible debt, option pricing models (such as the Black-Scholes-Merton model) may be used to establish the value.

Debt Terms

When applying the income approach, another important consideration is determining the relevant terms of the transaction. The debt agreement often defines certain terms such as the principal amount, issue date, maturity date, amortization schedule, currency, and interest rate.

However, credit metrics associated with the transaction are often not readily available in the debt agreement. Therefore, valuation professionals may be required to determine the appropriate credit metrics (for example, cash flow coverage, fixed charge coverage, or loan-to-value) associated with the transaction or to perform credit rating analysis with an appropriate methodology (such as Moody’s or S&P), where applicable, as a basis for determining an appropriate discount rate.

Discount Rate

In a discounted cash flow analysis, the discount rate reflects an investor’s required return for the time value of money and the investment’s relative risks. The discount rate is applied to discount projected cash flow streams (for example, interest payments and principal amounts) to establish a present value estimate for the debt.

To establish an appropriate discount rate from FV and FMV perspectives, valuation professionals analyze company performance and credit metrics through the subject security and debt market data (for example, calibrated spreads, debt index trends, comparable company instruments, and other observable inputs such as Treasury and swap rates). Understanding the relevant market is crucial when reviewing comparable market data, since different market forces affect the prices of different instruments.

In cases where the company’s performance and the current credit profile differ significantly from the underwritten credit profile (either positively or negatively), it may be necessary to re-underwrite the loan by tranching different portions of the capital structure into the security at appropriate market levels. For instance, if a company issues a first-lien loan whose credit metrics are now akin to those of a unitranche loan, both first-lien and second-lien spreads should be brought to bear.

Market Approach

The market approach determines the FMV of debt relative to current direct market prices of similar debt. The primary steps include:

- Establish debt terms—determine the relevant terms of the transaction, such as the principal amount, issue date, maturity date, currency, amortization schedule, and interest rate (including if interest is paid-in-kind).

- Identify comparable transactions—perform searches to identify direct pricing information for comparable financial transactions.

- Determine value—establish the FV or FMV based on direct pricing information of comparable debt transactions.

Although the market approach may seem more straightforward than the income approach, reliable direct pricing information for sufficiently comparable debt transactions may be difficult to identify, making the income approach more commonly applied.

Cost or Asset Approach

The cost or asset approach estimates the financial transaction’s value recoverable upon liquidation. This approach, which typically applies in two circumstances, is often applied for pricing and valuing nonperforming debt, where debt value exceeds the value of assets. The two situations are:

the restructuring of a going concern—If a company’s capital structure is expected to be restructured but the company continues operating as a going concern, an enterprise value coverage analysis may be performed to estimate the FV or FMV that will be recovered upon restructuring; and

a liquidation event—If an entity is expected to be liquidated, an analysis of the company’s balance sheet assets and appropriate recovery rates in an orderly liquidation will be used to estimate the FV or FMV of the debt.

Valuation Methods Under ALS

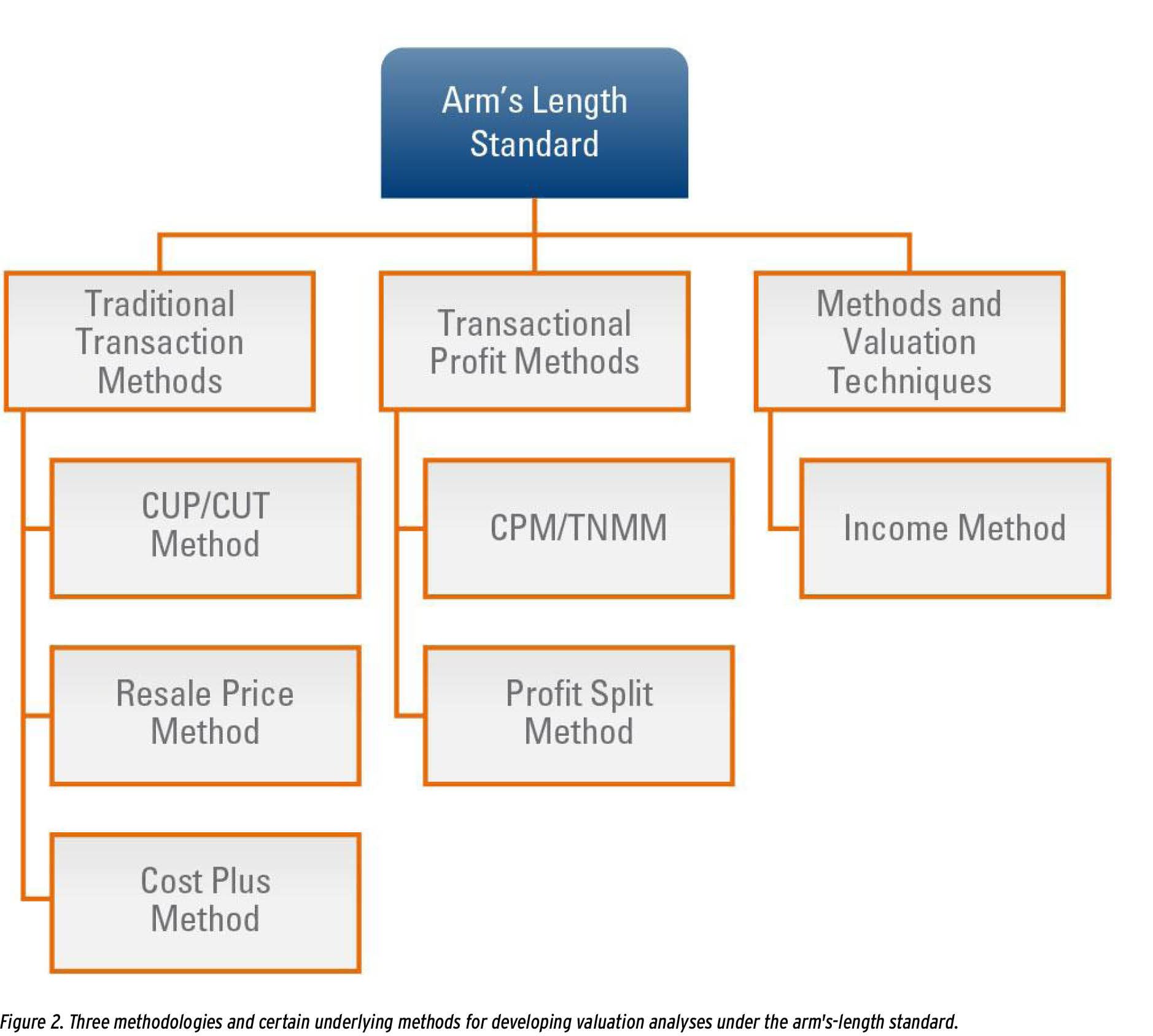

This section addresses certain commonly applied debt valuation methods under the ALS. Figure 2 shows various arm’s-length methods.

We focus on the income method, which is commonly applied for the arm’s-length valuation of debt, and the CUP/CUT method that may be used to derive an appropriate discount rate during the income method.

Income Method

For debt valuations under the ALS, valuation professionals must consider the transfer pricing rules described in the Treasury Regulations under Section 482 of the Internal Revenue Code (IRC). For cross-border transactions, the Organisation for Economic Co-operation and Development’s (OECD’s) Transfer Pricing Guidelines (hereinafter the OECD Guidelines) may need to be considered as well.

According to Treasury Regulations Section 1.482, evaluating whether a controlled transaction produces an arm’s-length result should be evaluated according to the best method rule.7 The regulations provide several specified methods, such as the comparable uncontrolled price (CUP) method,8 the comparable uncontrolled transaction (CUT) method,9 the comparable profits method (CPM),10 and the profit split method (PSM).11 Additionally, the regulations allow for other methods to evaluate arm’s-length results in a controlled transaction if applied following the provisions of Section 1.482-1.12 Such methods are “unspecified” and may include methods under Section 1.482-7 of the regulations, such as the income method applied for determining arm’s-length results for controlled transactions involving cost-sharing arrangements.13

Chapter 2 of the OECD Guidelines discusses several methods to establish arm’s-length pricing, including traditional transactional methods14 such as the CUP method, the resale price method (RPM), the cost plus method (CPLM), and transactional profit methods,15 such as the transactional net margin method and the transactional profit split method. Not specifically in the context of financial transactions, but the OECD Guidelines do recognize that valuation techniques may be applied when reliable, comparable, uncontrolled transactions are unavailable. Income-based valuation techniques may often be appropriate, such as discounted value of projected income streams or cash flows. Depending on the specific facts and circumstances, taxpayers and tax administrators may use valuation techniques as part of the OECD transfer pricing methods described in Chapter 2 of the OECD Guidelines or to identify an appropriate arm’s-length price.16

The income method under the ALS generally includes the following steps:

- Project cash flows—establish the cash flow streams associated with the debt, including appropriate projected interest payments and principal amounts (that is, debt schedule).

- Establish debt terms—determine the terms of the debt, such as principal amount, issue date, maturity date, currency, credit rating, and interest rate.

- Estimate discount rate—derive an appropriate discount rate for the debt, possibly through other transfer pricing methods, such as the CUP/CUT methods.

- Discount cash flows—discount the projected cash flow streams to present value using the discount rate.

Overall, establishing an arm’s-length value of debt may be very similar under ALS and under FV and FMV. The primary difference lies in the type of credit analysis performed and the discount rate applied to discount the cash flow stream, which we discuss in the next section.

Discount Rate

Transfer pricing methods such as the CUP/CUT17 method may be required for ALS valuations to determine an appropriate discount rate. The CUP/CUT method identifies discount rates from comparable uncontrolled debt transactions under the OECD Transfer Pricing Guidelines and IRC Section 482.

The OECD Guidelines’ CUP method compares the price charged for property transferred in a controlled transaction to the price charged in a comparable uncontrolled transaction with comparable circumstances. If the two prices differ, this may indicate that the conditions of the commercial and financial relations of the associated enterprises are not at arm’s-length and that the price in the uncontrolled transaction may need to be used as the price in the controlled transaction (i.e., the arm’s length price).18

Given the widespread existence of borrowing and lending markets and the frequency of financial transactions between uncontrolled borrowers and lenders, as well as the widespread availability of information (for example, the loan’s characteristics, the borrower’s credit rating, or the specific issuance’s rating), applying the CUP method to financial transactions may be easier than in the

case of other types of transactions.19 The arm’s-length interest rate for a controlled financial transaction may be established based on publicly available information for financial transactions with comparable credit ratings, terms, conditions, and other factors.20

Arm’s-length interest rates can also be based on the returns of realistic alternative transactions with comparable economic characteristics. Depending on the facts and circumstances, realistic alternatives to loans could include bonds, loans, deposits, convertible debt, or commercial papers. In evaluating these alternatives as potential comparables, it is important to consider that, based on facts and circumstances, comparability adjustments may be required to eliminate the material differences between the controlled loan and the selected alternative, such as liquidity, maturity, the existence of collateral, or currency.21

Treasury Regulations Section 1.482 includes a similar method, the CUT method, according to which an arm’s-length interest rate is a rate that was or would have been charged when a debt was incurred in independent transactions between unrelated parties under similar circumstances. Factors to consider include the principal amount and duration of the loan, the security involved, the borrower’s credit standing, and the interest rate prevailing at the lender’s or creditor’s location for comparable loans between unrelated parties.22

Credit Rating

Unlike the FV and FMV methods, both Treasury Regulations 1.482 and the OECD Transfer Pricing Guidelines explicitly reference the borrower’s credit standing or credit rating as a factor in determining arm’s-length interest rates under the CUP/CUT method.

OECD Guidelines

According to the OECD Guidelines, the borrower’s creditworthiness is one of the main factors independent investors consider when determining an interest rate. Credit ratings can serve as a useful measure of creditworthiness and can help identify potential comparables or apply economic models in controlled transactions. Furthermore, in the case of intragroup loans and other controlled financial transactions, the effect of group affiliation may be an economically relevant factor influencing the pricing and valuation of these transactions.23

Considerations for Specific Affiliates

Several considerations are key in determining a credit rating for a specific affiliate within a group to assess controlled financial transactions. If a specific affiliate has a publicly available credit rating published by an independent credit rating agency, that rating may be used for an arm’s-length analysis of the affiliate’s controlled financial transactions. However, in most cases, publicly available credit ratings are available only for the group. An approach often used for a specific affiliate is to analyze the individual characteristics of the affiliate using publicly available financial tools or independent credit rating agencies’ methodologies (for example, S&P or Moody’s) to replicate the process used to determine the credit rating of the group. This approach also accounts for improvements in creditworthiness that the specific affiliate would be assumed to receive due to its group affiliation (that is, implicit support).24

Implicit Support and Credit Rating

Implicit support from the group may influence the specific affiliate’s credit. The relative status of an affiliate within the group may help determine the extent of potential group support. Group members with stronger links (that is, entities that are integral to the group’s identity or important to its future strategy, often operating in its core business) are more likely to receive support from other group members. Consequently, their credit ratings are more closely linked to the group. Conversely, entities with weaker links (that is, entities that are less integral to the group or have limited strategic importance) may receive support in more limited circumstances. In cases where evidence suggests no support from the group, it may even be appropriate to use the stand-alone credit rating of the specific affiliate.25

Judgment in Assessing Implicit Support

Ultimately, assessing implicit support is a matter of judgment. The kind of information on which the group would base a decision to provide borrower support in particular circumstances may not be available to tax administrations. Changing facts and circumstances affecting the willingness or ability of the group to provide support may mean that no decision is made until the need for support arises. This scenario contrasts with situations where the affiliate receives a formal guarantee from another group affiliate. The group’s past behavior in providing support may indicate likely future behavior. However, an appropriate analysis should be undertaken to identify whether different conditions apply.26

Treasury Regulations 1.482 and the GLAM

Treasury Regulations Section 1.482-2 specifically references the borrower’s credit standing as essential to establishing arm’s-length interest rates for US tax purposes. Until the Internal Revenue Service issued General Legal Advice Memorandum 2023-008 (GLAM), formal guidance on the determination of the borrower’s credit standing and whether implicit support should be considered was limited.

Credit Analysis and Implicit Support

The GLAM clarified the IRS’ position and argued that implicit support should be considered, since an unrelated lender would consider group affiliation when establishing financing terms available to the borrower. If such third-party financing is realistically available, the IRS may adjust the interest rate in a controlled lending transaction to reflect group affiliation.27

Taxpayers may argue that interest rate reduction from group affiliation should be ignored if based on an expectation of the lender’s financial support, since the lender does not benefit from its support. However, the GLAM states that this argument relies on the ownership relationship with the borrower and must be rejected.28

According to the GLAM, commercial lenders analyze an unrelated borrower’s financial standing and business prospects to evaluate risk in extending credit. Commercial lenders commonly use a credit rating system, where rating agencies categorize entities based on their credit risk. When rating a group affiliate, a rating agency may separately assess both the affiliate’s stand-alone creditworthiness and the group credit profile. 29

When deriving an affiliate’s credit rating from the stand-alone and group credit profiles, the rating agency may consider:

- the relationship of the affiliate’s businesses and assets to the overall group; and

- the likelihood that another group affiliate would provide implicit financial support even in the absence of a formal commitment.

According to the GLAM, such implicit financial support is not separately compensable and should be considered when performing a credit rating analysis of a group affiliate.30

Interaction With Section 385 Debt Capacity Analysis

When analyzing financial transactions, another important consideration in addition to the amount of deductible interest is the characterization of the financial transaction under IRC Section 385. Specifically, taxpayers are allowed to deduct interest expense only if the transaction is classified as debt, not equity. According to IRC Section 385, the Treasury secretary is authorized to prescribe regulations to determine whether an interest in a corporation should be treated as equity or debt based on certain factors, such as the corporation’s debt-to-equity ratio.31 Additionally, tax court cases have established several factors that could help taxpayers accurately delineate such transactions. For example, in the Estate of Mixon v. United States, one of the primary factors considered was whether the borrower was thinly or adequately capitalized.32

Adequate capitalization is often established through debt capacity analysis, which may include:

- cash flow analysis—evaluating the borrower’s ability to service the interest payments and repay or refinance the debt at maturity; and

- financial ratio analysis—comparing the borrower’s financial ratios (for example, debt coverage, interest coverage, or leverage ratios) against those of comparable entities over the debt term.

When performing the debt capacity analysis, one major factor is the projected interest rate. A key question arises: Should implicit support be considered in Section 385 analyses? If implicit support is considered, the upward-adjusted credit rating and downward-adjusted interest rate result in a higher debt capacity than the borrower’s stand-alone debt capacity.

Interaction With Credit Ratings Under the FMV Standard

In addition to the determination of the interest rate on a financial transaction and its accurate delineation, another issue that may arise in US tax context is the fair market value of the financial transaction. The FMV standard applies to the case of a willing seller and a willing buyer, where neither party is under any compulsion to sell or buy, and both have reasonable knowledge of relevant facts.

An important question arises: Should implicit support be considered during an FMV analysis when establishing an appropriate discount rate? If implicit support is considered, the upward-adjusted credit rating and downward-adjusted discount rate result in a higher FMV than the stand-alone FMV of the debt.

Conclusion

Given the differences among the FV, FMV, and ALS standards, it is essential to identify the appropriate tax valuation and pricing standard as the first step when valuing financial transactions. If multiple financial reporting and tax valuation and pricing standards must be satisfied, companies should take appropriate steps to ensure consideration of and compliance with all relevant rules and requirements to avoid potential controversy.

Tom K. Gottfried and Ryan MacLean are managing directors at Valuation Research Corporation.

Editor’s note. This article is provided solely for educational purposes; it does not take into account any specific individual’s or entity’s facts and circumstances. It is not intended, and should not be relied upon, as tax, accounting, or legal advice. Valuation Research Corporation expressly disclaims any liability in connection with the use of this article or its contents by any third party.

Endnotes

- Financial Accounting Standards Board (hereinafter FASB) ASC 820-10-35-2.

- FASB ASC 820-10-35-9.

- FASB ASC 820-10-35.

- IRS Revenue Ruling 59-60.

- Treasury Regulations Section 1.482-1(b).

- Treasury Regulations Section 1.482-1(b).

- Treasury Regulations Section 1.482-1(b).

- Treasury Regulations Section 1.482-3.

- Treasury Regulations Section 1.482-4.

- Treasury Regulations Section 1.482-5.

- Treasury Regulations Section 1.482-6.

- Treasury Regulations Sections 1.482-3(e), 1.482-4(d), and 1.482-9(h).

- Treasury Regulations Section 1.482-7(g).

- Organisation for Economic Co-operation and Development, OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, 2022, paragraph 2.1, https://read.oecd-ilibrary.org/taxation/oecd-transfer-pricing-guidelines-for-multinational-enterprises-and-tax-administrations-2022_0e655865-en#page1 (hereinafter OECD Guidelines).

- OECD Guidelines, paragraph 2.1.

- OECD Guidelines, paragraph 6.153.

- Similarly to the CUT method applied for pricing of intangible transactions (for example, to establish comparable royalty rates) under Treasury Regulations Section 1.482-4, the market-based interest rate method establishes pricing for debt transactions (for example, comparable interest rates) based on comparable uncontrolled transactions. Although technically different methods under Treasury Regulations Section 1.482, the two methods are very similar. For ease of reference, we refer to the market-based interest rate method under Treasury Regulations Section 1.482-2 as the CUT method in this article.

- OECD Guidelines, paragraph 2.14.

- OECD Guidelines, paragraph 10.90.

- OECD Guidelines, paragraph 10.91.

- OECD Guidelines, paragraph 10.93.

- Treasury Regulations Section 1.482-2(a)(2).

- OECD Guidelines, paragraph 10.62.

- OECD Guidelines, paragraph 10.71.

- OECD Guidelines, paragraph 10.78.

- OECD Guidelines, paragraph 10.80.

- Internal Revenue Service General Legal Advice Memorandum 2023-008.

- Internal Revenue Service General Legal Advice Memorandum 2023-008.

- Internal Revenue Service General Legal Advice Memorandum 2023-008.

- Internal Revenue Service General Legal Advice Memorandum 2023-008.

- Internal Revenue Code Section 385.

- Estate of Mixon v. United States, 72-2 USTC paragraph 9537, 464 F.2d 394 (Fifth Circuit 1972), Court Opinion.