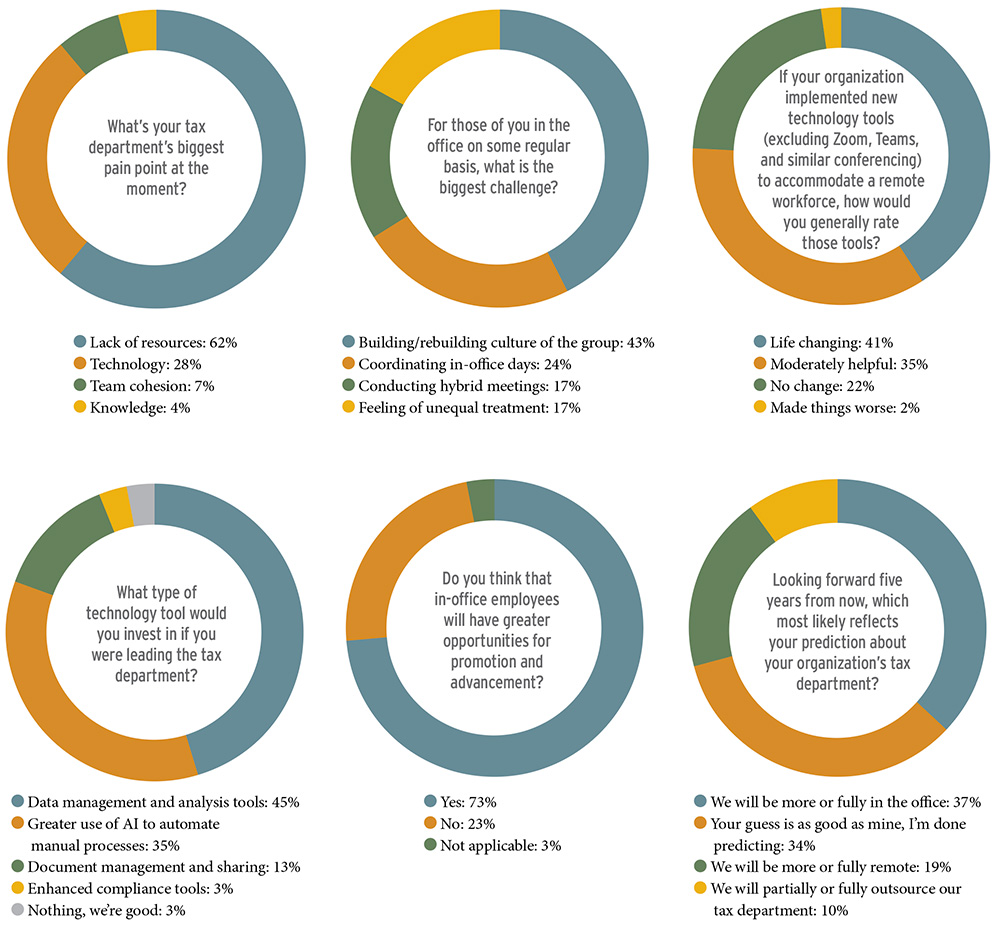

At TEI’s 77th Annual Conference this past October, one standout session, “A Tax Family Feud: An Interactive Discussion of Tax Department Challenges and Opportunities,” featured an all-star panel comprising Jack Hart, director at Brewer Morris; Satnam Singh, chief product officer, tax and trade, at Thomson Reuters; Jeffrey Friedman, partner at Eversheds Sutherland; Sandhya Edupuganty, TEI senior vice president and vice president, tax and treasury, at E2open LLC; and Wayne Monfries, TEI international president and senior vice president, global tax, at Visa Inc. The group discussed the status, direction, and goals of today’s in-house tax departments and offered attendees the opportunity to participate in a survey about their tax departments. Here are some of the results from that survey.