TEI’s webinar series, Preparing for Pillar Two: Practical Steps for MNEs to Meet the Global Minimum Tax Rules, was a resounding success, with high levels of attendee engagement, excellent feedback, and high ratings across categories. Hosted virtually over six days on September 9–11 and 16–18, the inaugural webinar series offered a live, interactive format designed to help multinational enterprise tax professionals navigate the complexities of the global minimum tax.

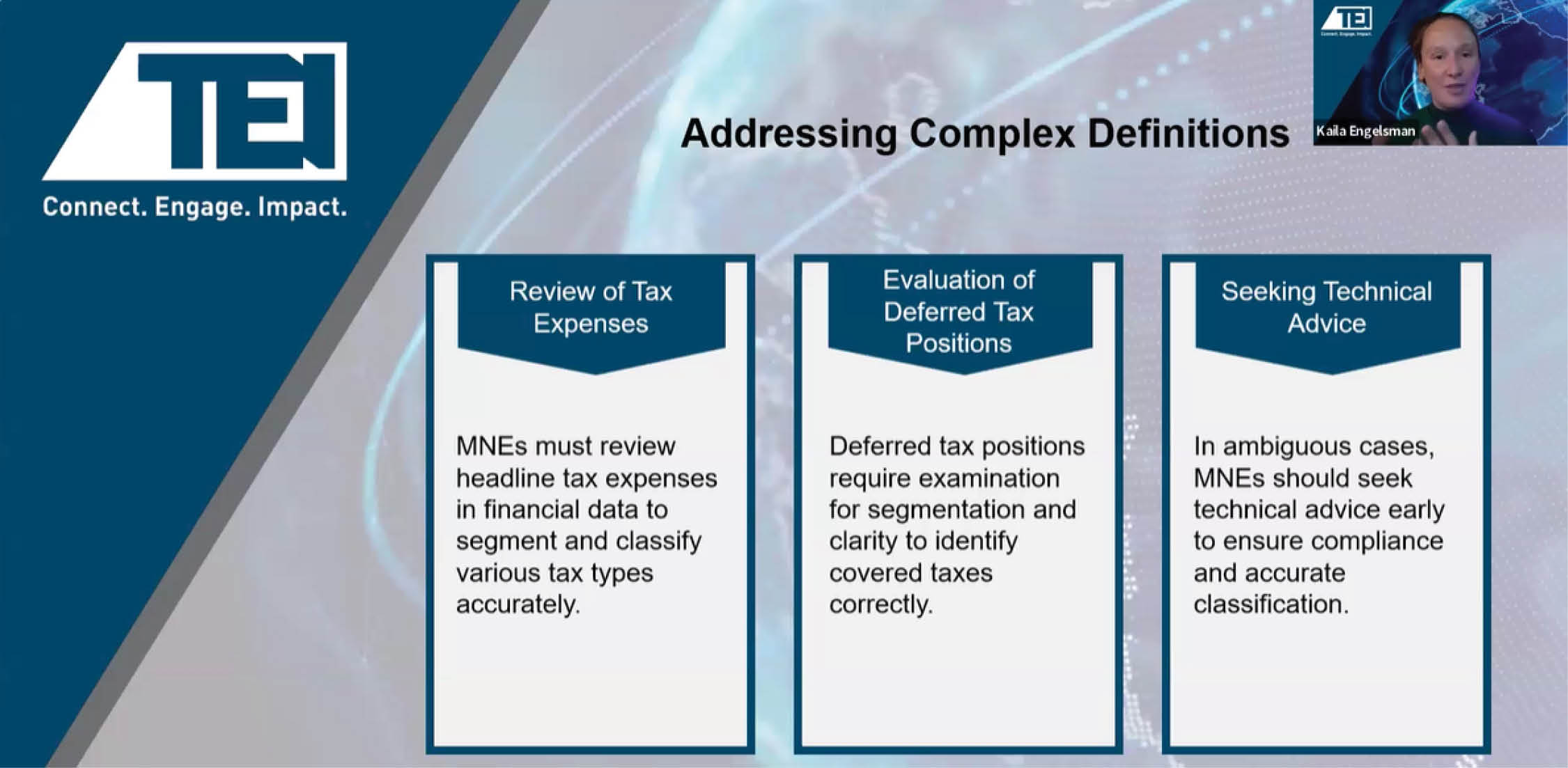

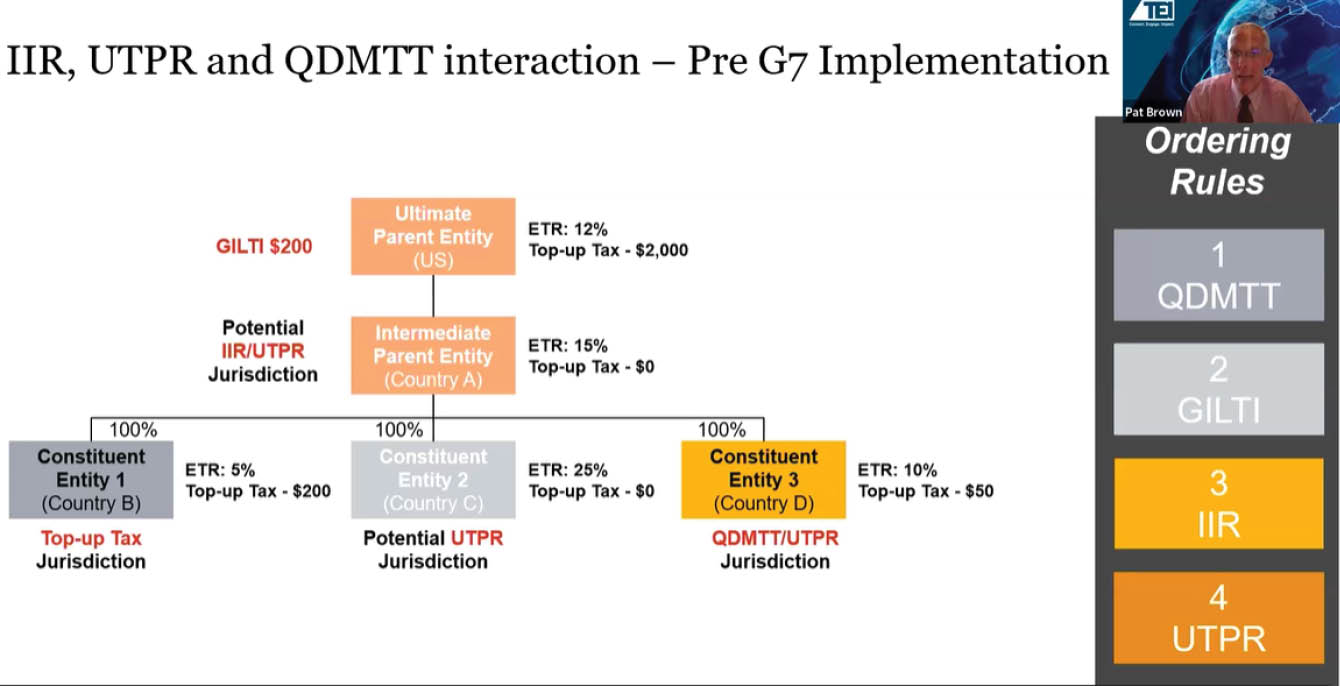

The series featured a comprehensive lineup of sessions covering the latest on Pillar Two, global anti-base erosion income and covered taxes computation, definitional issues in certain jurisdictions, qualified domestic minimum top-up taxes and safe harbors, compliance considerations, financial reporting and audit implications, and practical readiness from an in-house perspective. Attendees also explored M&A considerations and dispute prevention strategies and participated in an interactive case study.

Breakout sessions tailored to Canada, EMEA, and Latin America ensured that participants received region-specific insights and actionable guidance, making the content relevant and applicable regardless of where their organizations operate.

TEI is grateful to all who played a role in the success of this series and offers special thanks to all speakers for their time, valuable insights, and experience. As Pillar Two continues to evolve, particularly in light of the G7 agreement to construct a “side-by-side” system for US-headquartered multinationals, TEI will assess future programming on the topic and continue its tradition of providing timely, practical guidance for the in-house tax professional community.