The Tax Foundation has been tracking the economic impact of the Trump administration-imposed tariffs in the United States and around the world. Because the tariff landscape seems to change almost weekly—if not more often—the Tax Foundation offers a full timeline of tariff activity involving the United States, dating back to 2018 when Turkey announced it would begin placing tariffs on approximately $266.5 million of US goods.

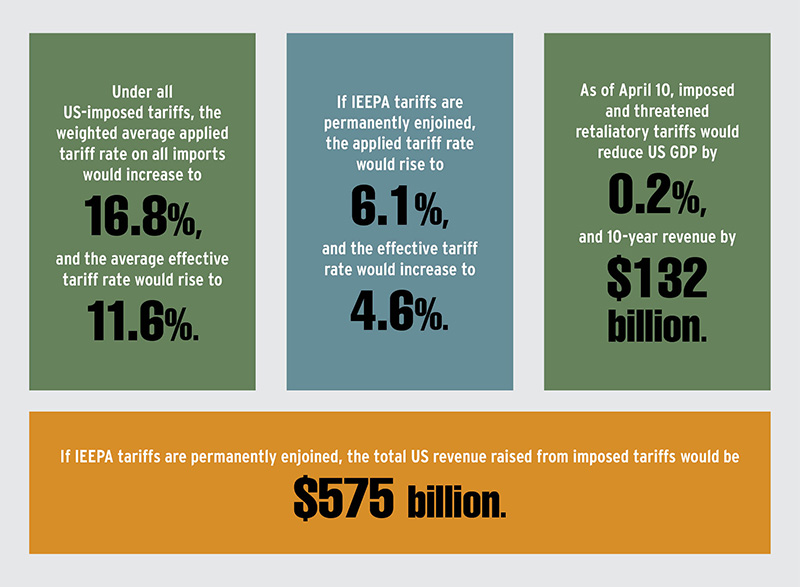

In February, the Tax Foundation’s General Equilibrium Model estimated that the United States would gain $2.4-plus trillion over ten years (2025–2034) in conventional revenue. However, it projected a drop in US gross domestic product and capital stock by 0.8 percent and 0.7 percent, respectively. It remains to be seen how US-imposed tariffs will evolve and how they will ultimately affect the global economy, especially considering that as of early April, China, Canada, and the European Union have either announced or imposed retaliatory tariffs on some $330 billion of US exports, according to the Tax Foundation. There’s also a chance that International Emergency Economic Powers Act (IEEPA) tariffs, such as those on Canada, Mexico, and China, are permanently enjoined—they were ruled illegal by the US Court of International Trade in May—and the revenue raised by the Trump administration’s tariffs would see a drop.

Below are further estimates and key findings from the Tax Foundation’s reporting. To stay up to date on the numbers and economic impacts of US-imposed tariffs, visit www.taxfoundation.org/research/all/federal/trump-tariffs-trade-war.

Source: Erika York and Alex Durante, “Trump Tariffs: Tracking the Economic Impact of the Trump Trade War,” Tax Foundation (October 3, 2025), https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war.