TEI continues to stand strong on its three foundational pillars: education, networking, and advocacy. These pillars are the cornerstones of TEI’s mission and the driving force behind our continued success as the leading voice for in-house tax professionals worldwide.

Recognizing TEI’s Legal Staff and Advocacy Leadership

At the heart of TEI’s advocacy efforts is our exceptional legal staff, whose talent and dedication have strengthened TEI’s reputation as one of the most respected tax advocacy organizations in the world.

Over the past year, TEI has submitted twenty-six comment letters and briefs to various governmental agencies and courts—addressing proposed regulations, pending litigation, and other issues critical to the corporate tax community. I have personally witnessed how TEI’s advocacy can shape legislative outcomes and influence judicial decisions.

I would like to extend my sincere appreciation to our legal staff—Chief Tax Counsel Patrick Evans and Tax Counsels Ben Shreck, Todd Lard, and Kelly Madigan—for their commitment and positive impact on the profession.

Please reach out to any member of the legal staff with suggestions or opportunities for TEI to further advance its advocacy on behalf of the corporate tax community.

Engaging Through TEI’s Technical Committees

One of the most rewarding aspects of my twenty-five-year involvement with TEI has been participating in our technical tax committees. These committees serve as a cornerstone of professional growth and collaboration by offering members a unique opportunity to stay current on emerging tax issues, exchange insights, and build strong professional networks.

Each committee typically meets virtually once per month to discuss recent developments and technical topics of interest. I have had the privilege of serving as vice chair of the State & Local Tax (SALT) Committee for the past four years. This experience has allowed me to apply insights gained from our monthly meetings directly to my work at First Horizon Bank. This is one of many examples of how TEI’s collaborative structure benefits both members and their organizations.

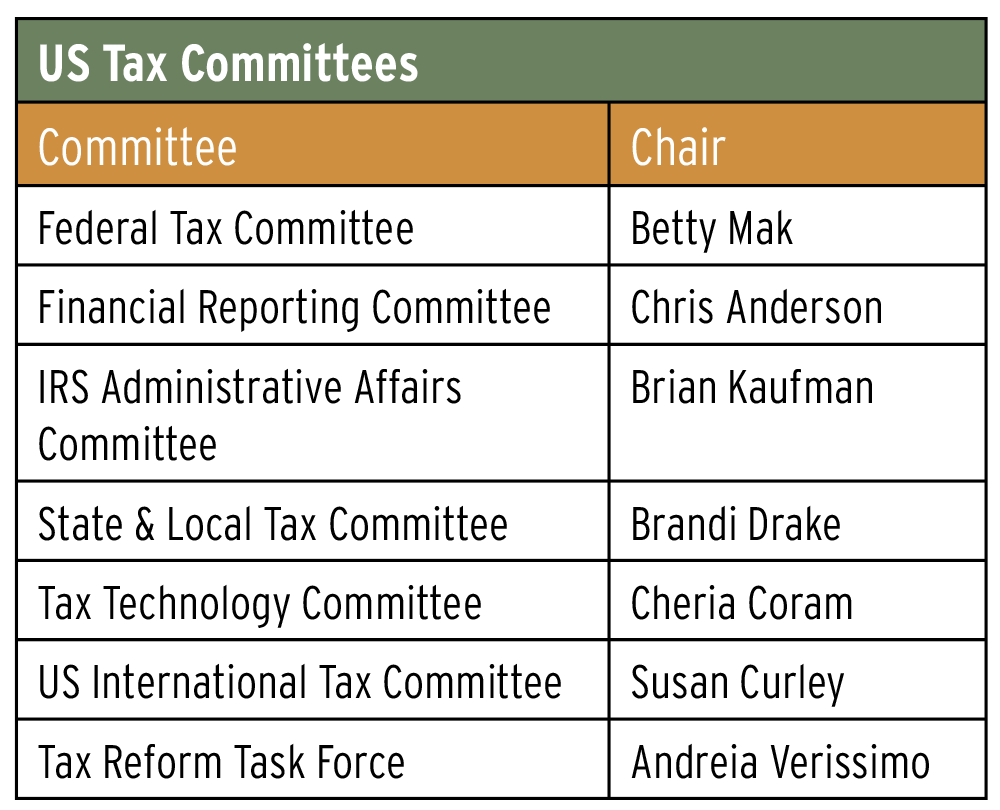

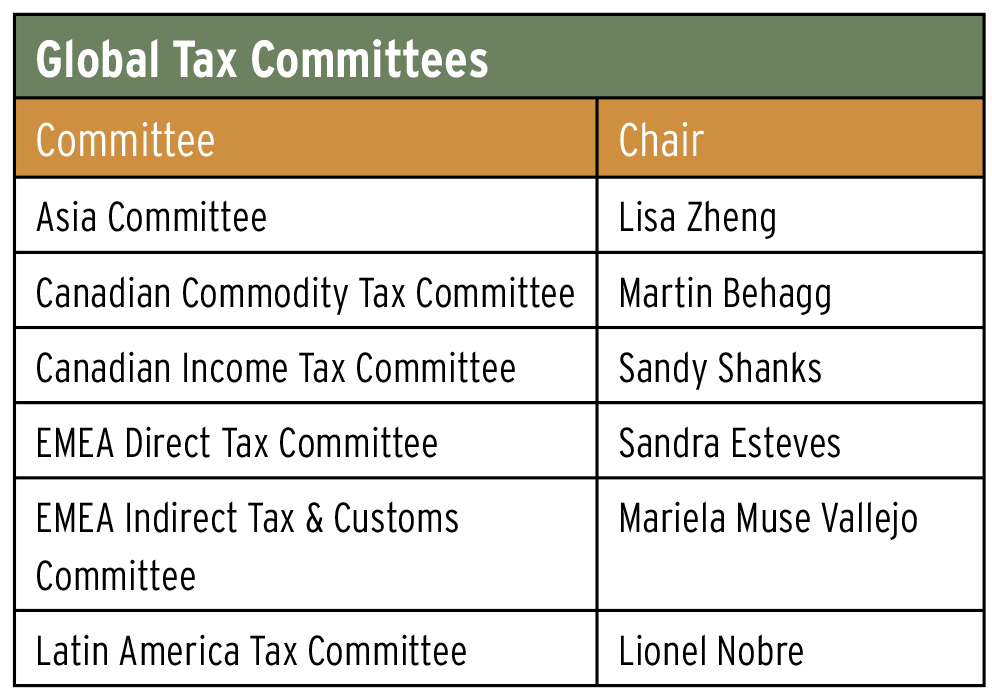

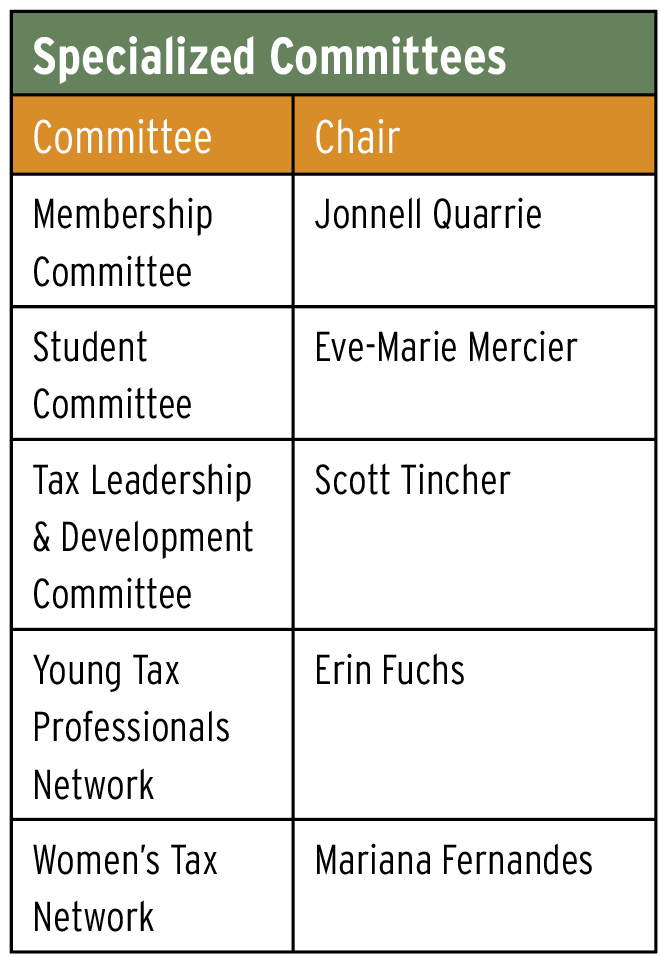

TEI’s Standing Committees and Leadership

Below are TEI’s current standing tax committees and committee chairs. I encourage every member—and members of your teams—to become actively involved. Committee participation is an excellent way to expand your technical expertise, share your experience, and contribute to TEI’s mission of leadership in tax policy and practice.

Looking Ahead

As we continue to advance TEI’s mission and serve our members, I look forward to connecting with many of you at the Midyear Conference, March 15–18, in Washington, D.C.

Please do not hesitate to contact me with your ideas, feedback, and suggestions to help make TEI an even stronger organization. Together, we will continue to strengthen the Institute’s proud tradition of education, networking, and advocacy.

Warm regards,

Walter B. Doggett III

TEI International President