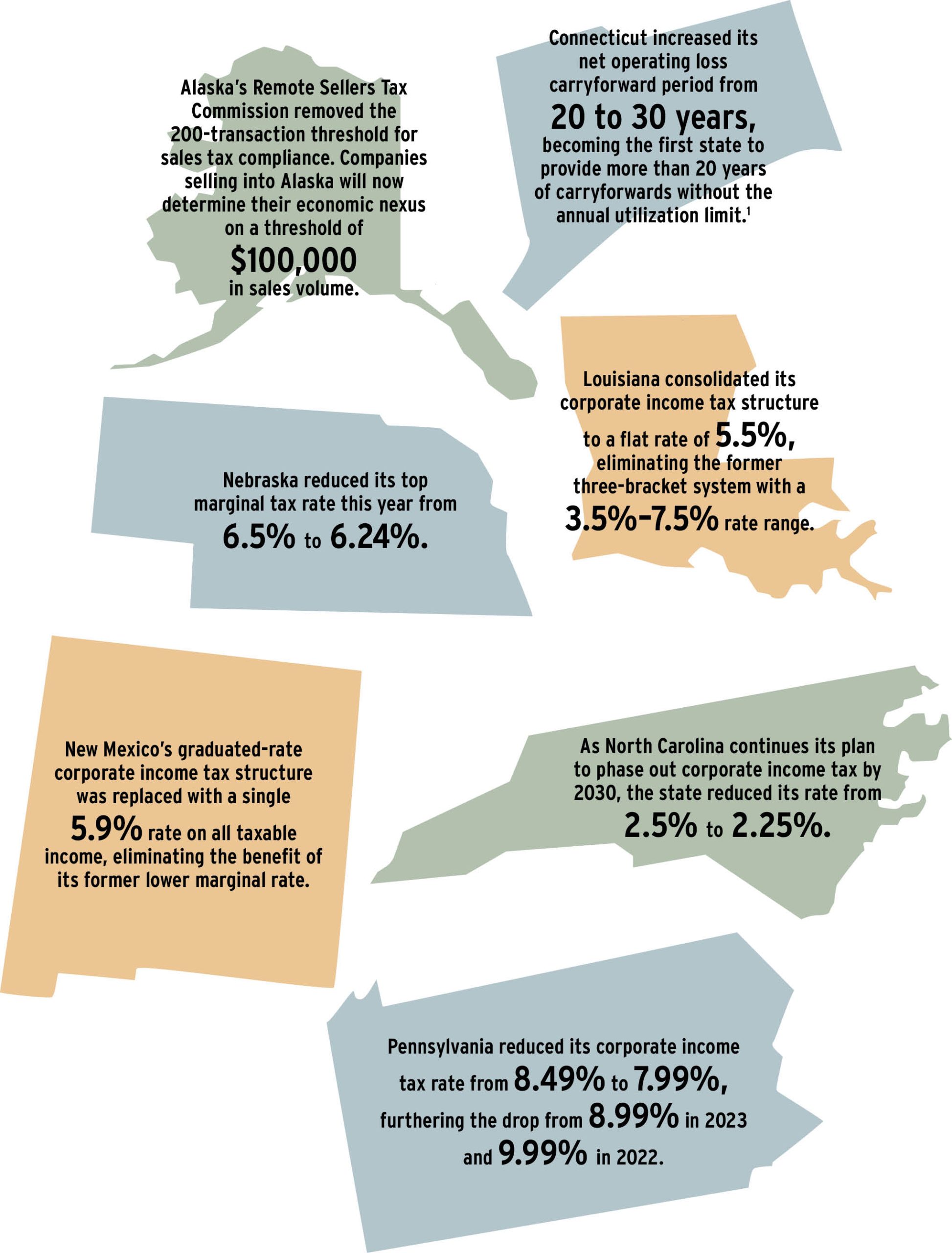

This year, thirty-nine states made significant changes to their tax codes, effective January 1, continuing a trend of tax reforms to which we’ve become accustomed over the past several years. Changes to the tax code in seven states—Alaska, Connecticut, Louisiana, Nebraska, New Mexico, North Carolina, and Pennsylvania—are highlighted below, and although some are simply continuations of ongoing efforts to lower corporate income tax rates, others are perhaps more notable.

Some states with important changes—but perhaps not fitting for the By the Numbers format—that affect in-house tax professionals are Illinois, Massachusetts, Mississippi, and New Jersey, among others. To see those adjustments and to get a more thorough rundown on this year’s state tax updates, visit www.taxfoundation.org/research/all/state/2025-state-tax-changes.

Source: Joseph Johns, Abir Mandal, Jared Walczak, and Jacob Macumber-Rosin, “State Tax Changes Taking Effect January 1, 2025,” Tax Foundation, December 19, 2024, https://taxfoundation.org/research/all/state/2025-state-tax-changes.

Endnote

- Many states now allow carryforwards for an indefinite number of years, but, following federal guidance, cap carryforwards at eighty percent of liability in a year. Rhode Island also increased its carryforward period, but just up to twenty years.