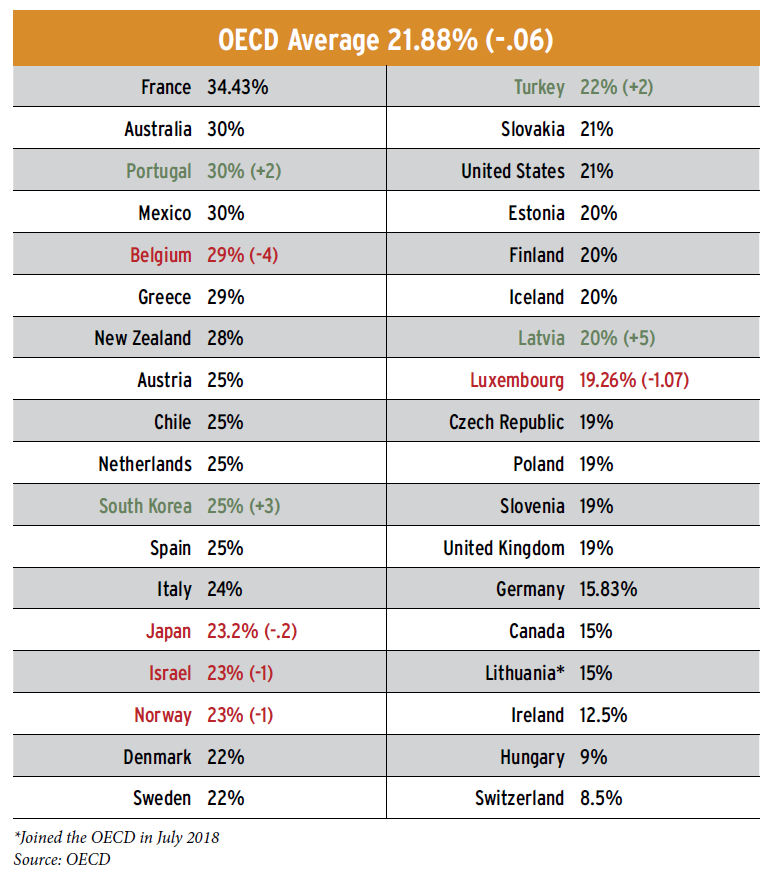

Several significant shake-ups to tax codes around the world, especially in the United States, Belgium, and Latvia, among others, leave us with a global landscape that differs significantly from that of 2017. In the March/April 2018 issue of Tax Executive, we printed the 2017 statutory corporate income tax rates for each country in the Organisation for Economic Co-operation and Development (OECD). Below are the 2018 tax rates for all countries in the OECD, with the percentage of increase or decrease from 2017 noted. Although the reasons vary by country, the one certainty is that the global tax world is regularly evolving, requiring tax professionals whose companies do business internationally to be constantly adaptive and agile.

Are Tax Insurance Proceeds Taxable? Tax insurance has emerged as a cornerstone of corporate tax…

OBBBA Modifications to US Taxation of International Income The One Big Beautiful Bill Act (OBBBA), which was signed…

How Does Conformity Impact State Revenues After the OBBBA? State conformity with the Internal Revenue Code (IRC) refers to…

Are Research Credit Interviews and Write-Ups Obsolete? Upon joining a Big Four firm in Washington, D.C.—then known…

Janelle Gabbianelli According to Janelle Gabbianelli, her first job was the catalyst…

Why Co-Sourcing Tax Technology Is Your Best Bet In today’s complex regulatory landscape, tax departments are being pushed…