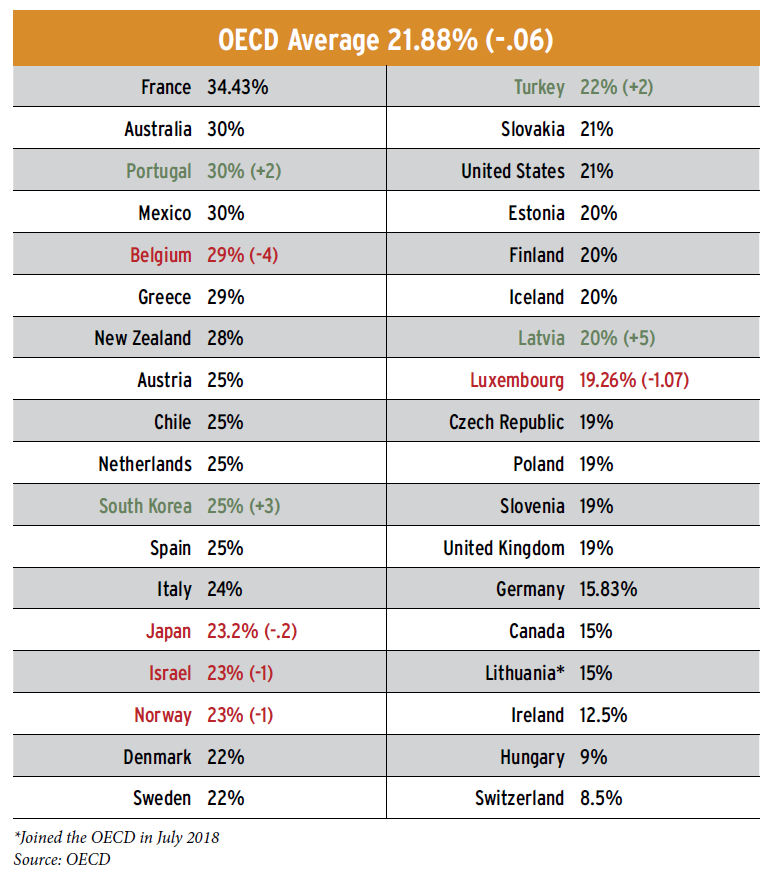

Several significant shake-ups to tax codes around the world, especially in the United States, Belgium, and Latvia, among others, leave us with a global landscape that differs significantly from that of 2017. In the March/April 2018 issue of Tax Executive, we printed the 2017 statutory corporate income tax rates for each country in the Organisation for Economic Co-operation and Development (OECD). Below are the 2018 tax rates for all countries in the OECD, with the percentage of increase or decrease from 2017 noted. Although the reasons vary by country, the one certainty is that the global tax world is regularly evolving, requiring tax professionals whose companies do business internationally to be constantly adaptive and agile.

AI in the Tax Department: Getting Tax a Seat at the Table Artificial intelligence (AI) is reshaping business functions rapidly, yet many…

TEI Roundtable No. 51: The Future Corporate Tax Department As tax moves into the future, in-house professionals are experiencing…

The Impact of AI in R&D Tax Credits For the last several years we’ve heard that artificial intelligence…

Making Sense of CAMT Complexity The corporate alternative minimum tax (CAMT) under Section 55 of…

Question: What Are the Key Updates in the FASB Income Tax Disclosure Requirements? In 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards…

Breaking Down Real-Time Controls in Global Tax As governments implement digital approaches to tax filing, reporting, operations,…