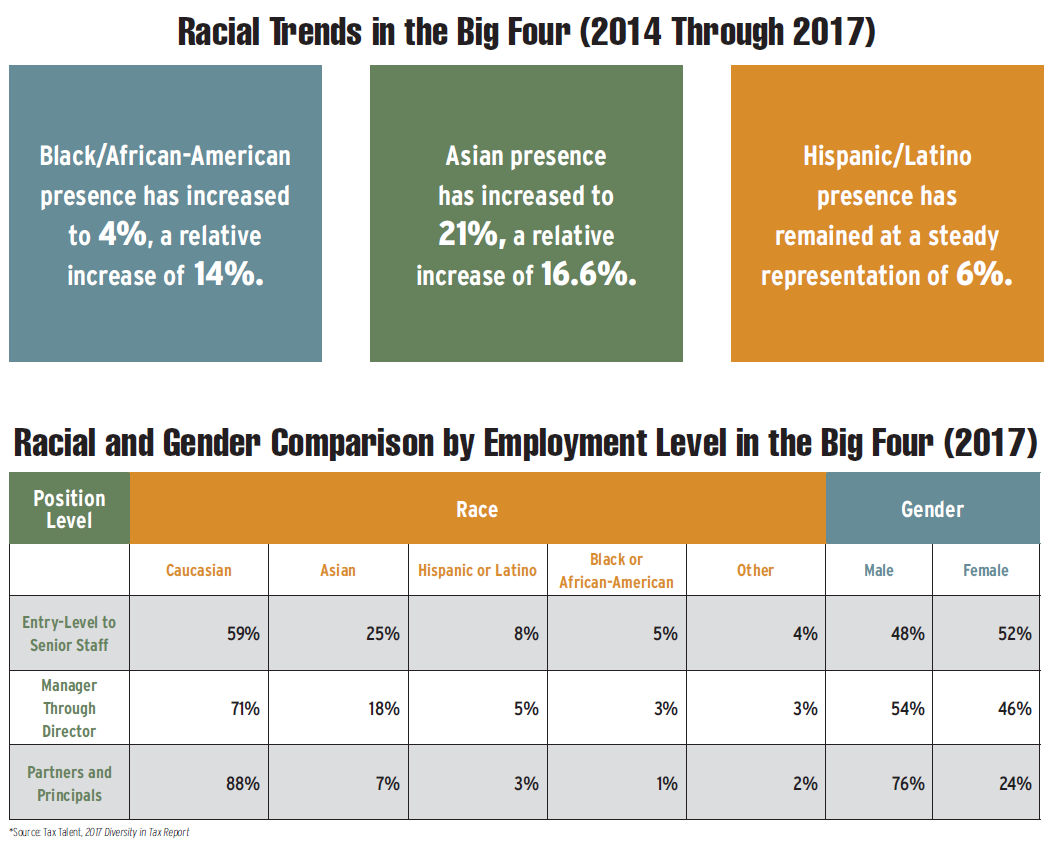

In December 2017, Tax Talent released its 2018 Diversity in Tax Report, which highlights diversity trends and, specifically, pinpoints racial and gender shifts in tax employment in 2017. Using Tax Talent’s database of corporate in-house tax professionals, combined with data from the U.S. Bureau of Labor Statistics, the American Institute of Certified Public Accountants’ 2017 Trends Report, and the Big Four public accounting firms—Ernst & Young, Deloitte, PricewaterhouseCoopers (PwC), and KPMG—the report indicates a gradual expansion in diversity overall, but not in more senior-, partner-, or principal-level roles. As Baby Boomers, who, in this industry, are generally represented by white males, retire and make way for the future, more diverse workforce, the overall trends will, it is hoped, become more prevalent in those higher-level positions. But let’s look at some current findings to see where we stand in 2018.

Are Tax Insurance Proceeds Taxable? Tax insurance has emerged as a cornerstone of corporate tax…

OBBBA Modifications to US Taxation of International Income The One Big Beautiful Bill Act (OBBBA), which was signed…

How Does Conformity Impact State Revenues After the OBBBA? State conformity with the Internal Revenue Code (IRC) refers to…

Are Research Credit Interviews and Write-Ups Obsolete? Upon joining a Big Four firm in Washington, D.C.—then known…

Janelle Gabbianelli According to Janelle Gabbianelli, her first job was the catalyst…

Why Co-Sourcing Tax Technology Is Your Best Bet In today’s complex regulatory landscape, tax departments are being pushed…