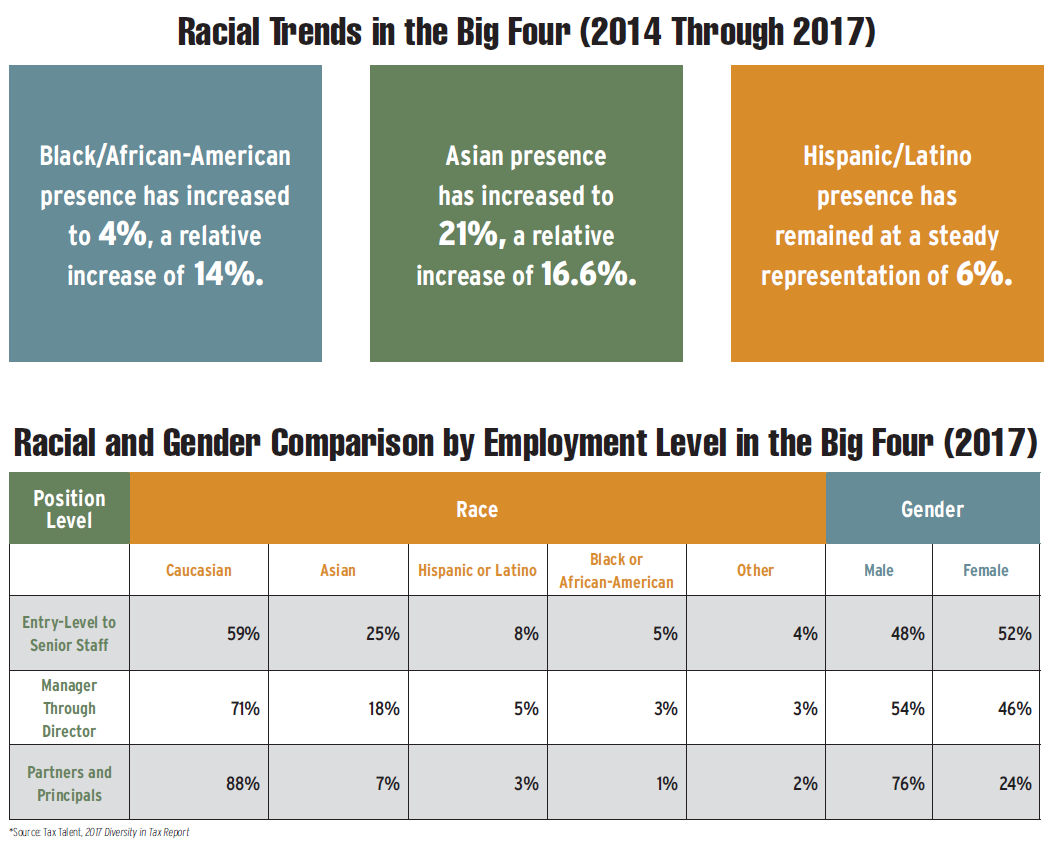

In December 2017, Tax Talent released its 2018 Diversity in Tax Report, which highlights diversity trends and, specifically, pinpoints racial and gender shifts in tax employment in 2017. Using Tax Talent’s database of corporate in-house tax professionals, combined with data from the U.S. Bureau of Labor Statistics, the American Institute of Certified Public Accountants’ 2017 Trends Report, and the Big Four public accounting firms—Ernst & Young, Deloitte, PricewaterhouseCoopers (PwC), and KPMG—the report indicates a gradual expansion in diversity overall, but not in more senior-, partner-, or principal-level roles. As Baby Boomers, who, in this industry, are generally represented by white males, retire and make way for the future, more diverse workforce, the overall trends will, it is hoped, become more prevalent in those higher-level positions. But let’s look at some current findings to see where we stand in 2018.

AI in the Tax Department: Getting Tax a Seat at the Table Artificial intelligence (AI) is reshaping business functions rapidly, yet many…

TEI Roundtable No. 51: The Future Corporate Tax Department As tax moves into the future, in-house professionals are experiencing…

The Impact of AI in R&D Tax Credits For the last several years we’ve heard that artificial intelligence…

Making Sense of CAMT Complexity The corporate alternative minimum tax (CAMT) under Section 55 of…

Breaking Down Real-Time Controls in Global Tax As governments implement digital approaches to tax filing, reporting, operations,…

Question: What Are the Key Updates in the FASB Income Tax Disclosure Requirements? In 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards…