Procedural State Tax Issues: Part II

Coordinating Multistate Litigation

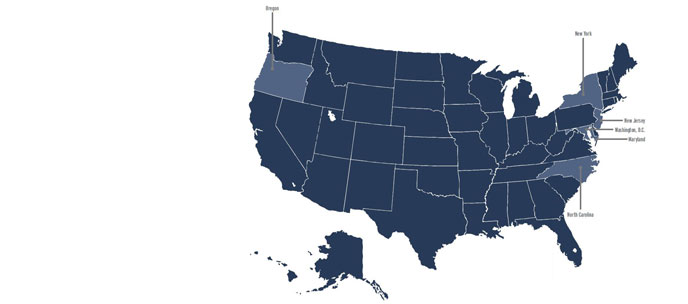

Managing state tax controversies is a complex task that involves an understanding of substantive and procedural rules that vary significantly by jurisdiction. Part I of this article, published in the May/June issue of Tax Executive, explored considerations for selecting the best forum for litigation. Part II of this article addresses…

AI in the Tax Department: Getting Tax a Seat at the Table Artificial intelligence (AI) is reshaping business functions rapidly, yet many…

TEI Roundtable No. 51: The Future Corporate Tax Department As tax moves into the future, in-house professionals are experiencing…

The Impact of AI in R&D Tax Credits For the last several years we’ve heard that artificial intelligence…

Making Sense of CAMT Complexity The corporate alternative minimum tax (CAMT) under Section 55 of…

Breaking Down Real-Time Controls in Global Tax As governments implement digital approaches to tax filing, reporting, operations,…

Question: What Are the Key Updates in the FASB Income Tax Disclosure Requirements? In 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards…