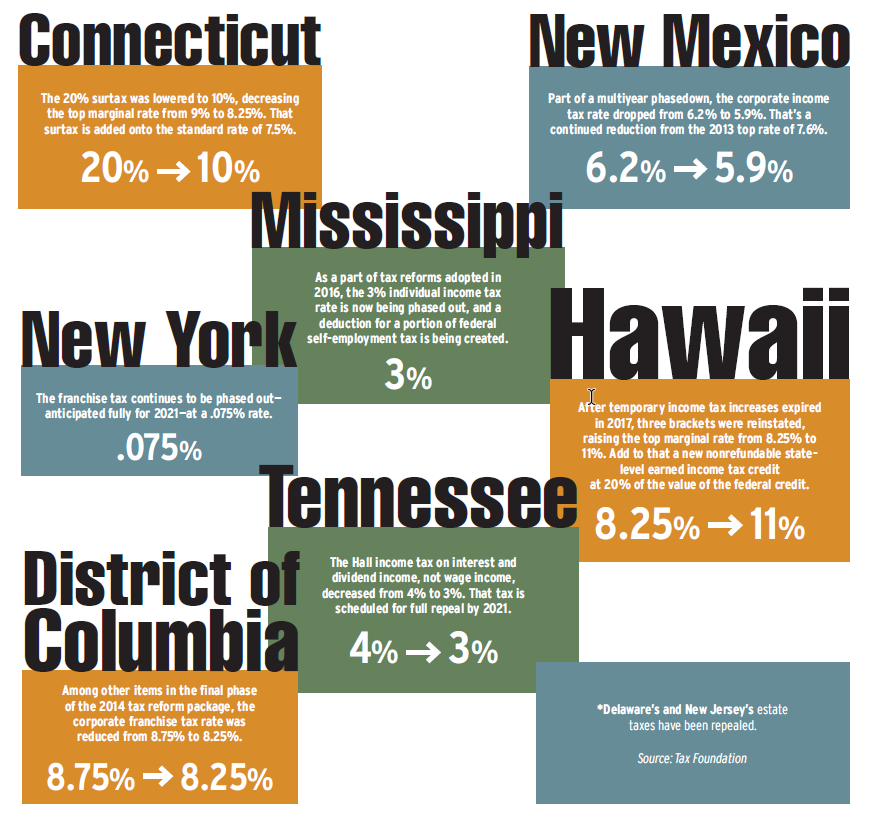

As the world of federal tax was shaken up by the passage of the Tax Cuts and Jobs Act of 2017, U.S. tax departments across the country continue to adjust. One of the main pieces of the new tax bill is the lowered corporate tax rate, which had not been adjusted since the 1980s. On the state level, however, corporate income taxes typically see yearly changes that should be noted. Because the Tax Cuts and Jobs Act affects all states, states have further impetus to evaluate their own tax codes. Below are some important state-level rate adjustments in 2018.

Are Tax Insurance Proceeds Taxable? Tax insurance has emerged as a cornerstone of corporate tax…

OBBBA Modifications to US Taxation of International Income The One Big Beautiful Bill Act (OBBBA), which was signed…

How Does Conformity Impact State Revenues After the OBBBA? State conformity with the Internal Revenue Code (IRC) refers to…

Are Research Credit Interviews and Write-Ups Obsolete? Upon joining a Big Four firm in Washington, D.C.—then known…

Janelle Gabbianelli According to Janelle Gabbianelli, her first job was the catalyst…

Why Co-Sourcing Tax Technology Is Your Best Bet In today’s complex regulatory landscape, tax departments are being pushed…