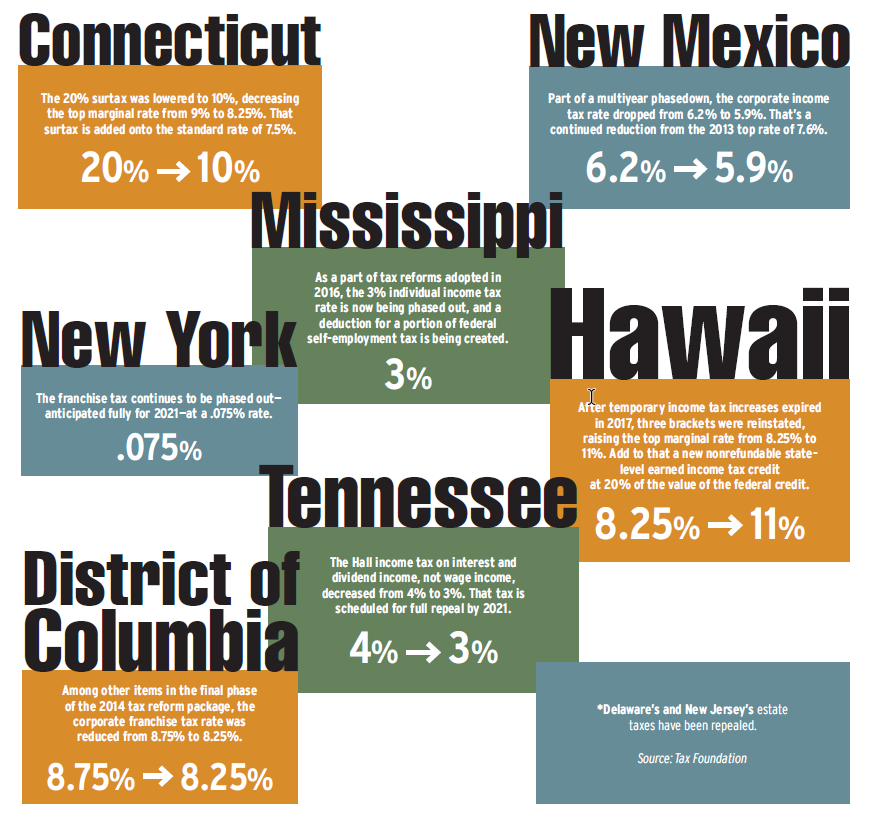

As the world of federal tax was shaken up by the passage of the Tax Cuts and Jobs Act of 2017, U.S. tax departments across the country continue to adjust. One of the main pieces of the new tax bill is the lowered corporate tax rate, which had not been adjusted since the 1980s. On the state level, however, corporate income taxes typically see yearly changes that should be noted. Because the Tax Cuts and Jobs Act affects all states, states have further impetus to evaluate their own tax codes. Below are some important state-level rate adjustments in 2018.

AI in the Tax Department: Getting Tax a Seat at the Table Artificial intelligence (AI) is reshaping business functions rapidly, yet many…

TEI Roundtable No. 51: The Future Corporate Tax Department As tax moves into the future, in-house professionals are experiencing…

The Impact of AI in R&D Tax Credits For the last several years we’ve heard that artificial intelligence…

Making Sense of CAMT Complexity The corporate alternative minimum tax (CAMT) under Section 55 of…

Question: What Are the Key Updates in the FASB Income Tax Disclosure Requirements? In 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards…

Breaking Down Real-Time Controls in Global Tax As governments implement digital approaches to tax filing, reporting, operations,…